So you've decided to ditch the spreadsheets and manual tracking and now searching for a software that automates this labor intensive process. Finding the right insurance tracking software for your business can be a daunting task. With so many options available, it's important to choose one that not only saves you time but also reduces risk. Luckily, we're here to help guide you through the process and provide you with all the information you need.

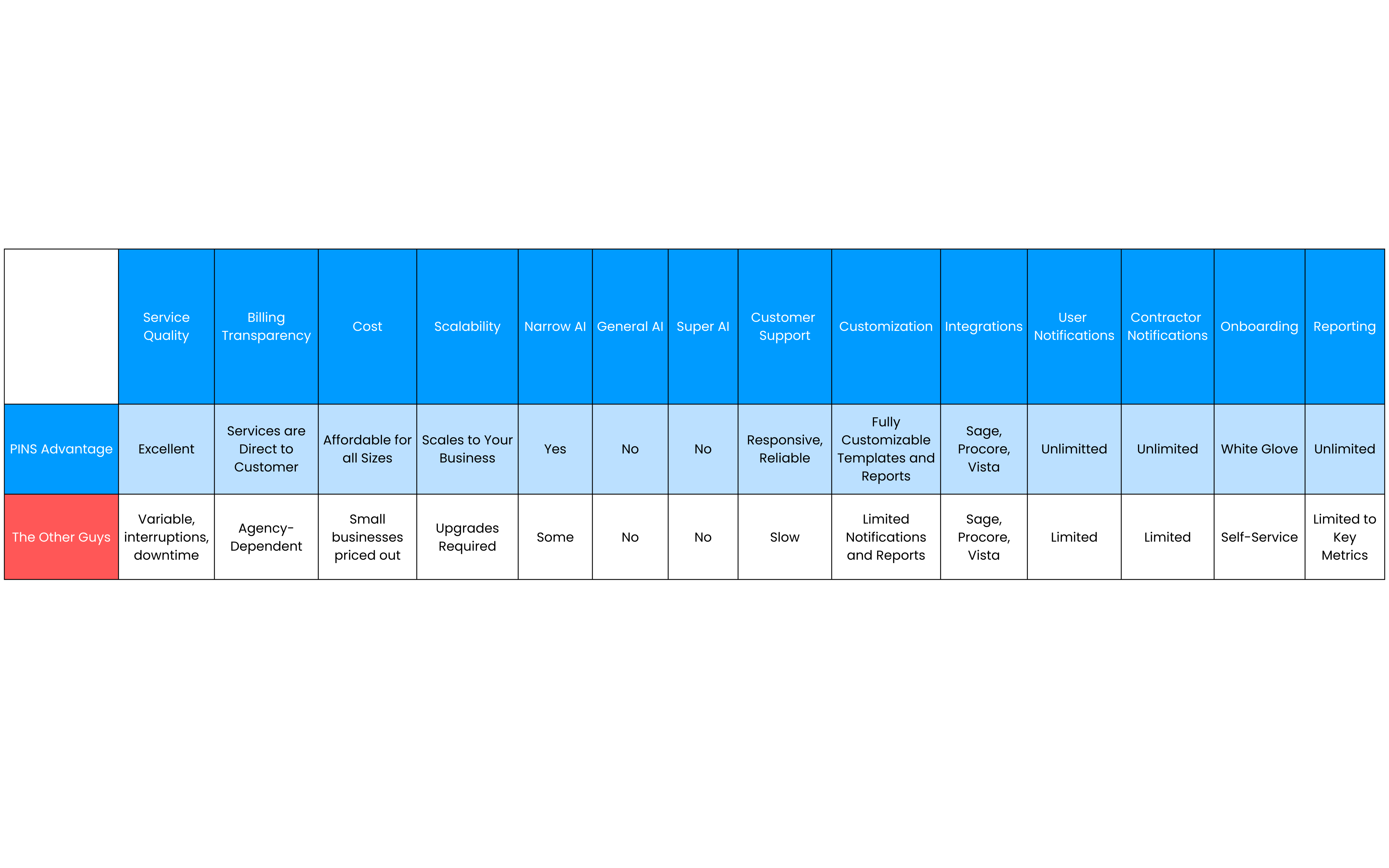

Use this post and the quick reference table below to evaluate features in your search for the right fit for your business.

Is the software easy to use?

Insurance tracking software should make it easier to track insurance certificates, not harder. The insurance tracking process has potential pitfalls that can interrupt the compliance process and increase expenses. Don’t let your tracking software cause delays with siloed-off workflows.

Consider whether the solution seems intuitive and easy to learn and use. Is it painless to review records, enter notes, and send notifications? Will it support the way you work? Will you have to change how you track contractor records to support the software – or will the software require expensive retooling to accommodate your process?

Your chosen solution should be streamlined and your provider should be open and honest about the capabilities of your solution.

How will it save you time?

When choosing a software to alleviate your manual process one of the first things that comes to mind is automation. COI (certificate of insurance) tracking software should automate as much of your process as possible. Can it take routine tasks like email follow-ups and manual date tracking off your plate. It should save you time, and make it easier to know the status of a vendor's compliance status instantly.

Does it offer time saving features like:

- Bulk Emailing

- Optical Character Recognition (OCR)

- Customizable Reporting

Does it offer integrations?

Insurance tracking isn’t processed in a vacuum. Before you commit to a solution, determine what data is critical and how it flows inside and outside your company.

Based on your business' workflow you want to select software that integrates with other key systems in your organization. Insurance data can be messy and interfaces can be a driver to reduce costs and implementation. Consider whether the solution offers integrations with other systems like Procore, Vista and Sage 300.

Is information protected and can it be transferred safely?

In this day and age, data security is of utmost importance. Fines and – even more important – reputational risk from data breaches or other cyber incidents can be crippling to your company.

Thoroughly review the the security documentation with your IT department to understand their measures. Evaluate each their security certifications to understand what each protection provides, even if it currently meets your own company’s thresholds. It is essential to understand the vendor’s commitment to protecting your data now and in the future.

Choose a vendor who will partner with you for implementation and beyond. They should provide thorough training and continued support.

Does it meet your company’s needs and future goals?

Carefully select a provider who meets the criteria you’re searching for, is willing to offload the risk from your business, is within your budget and can scale as your business and volume rises. Reporting and tools for business analysis should be accessible and scalable.

Searching for the right insurance tracking system can seem daunting, but it doesn’t need to be! Follow these recommendations to help you find the provider who stands out from the competition.

For more information about PINS Advantage and our automation tools, visit pinsadvantage.com.

Ready to learn more about PINS?